34+ Monthly 401k withdrawal calculator

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. Not an easy task.

I Am 29 I Have No Savings Or Financial Back Up Plan What Can I Do To Be Financially Smarter Save And Have A Better Financial Future As A Single Female Teacher

Choose the appropriate calculator below to compare saving in a 401 k account vs.

. The benefits of most of these plans include a tax deduction on any. Related 401K Calculator Roth IRA Calculator. 34 Monthly 401k withdrawal calculator Kamis 01 September 2022 Edit.

Simple 401k Calculator Terms Definitions. 100 Employer match 1000. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you.

Your employer needs to offer a 401k plan. This retirement calculator is for retirement planning. Withdrawal amount - The amount you are planning to withdraw monthly.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Expected Retirement Age This is the age at which you plan to retire. 34 Monthly 401k withdrawal calculator Kamis 01 September 2022 Edit.

25Years until you retire age 40 to age 65. This withdrawal rate calculator can be used to estimate monthly and annual income in retirement. Or withdrawals may be tax-free.

401k a tax-qualified defined-contribution pension account as defined in subsection 401 k of the Internal Revenue Taxation Code. The benefits of most of these plans include a tax deduction on any contributions but the downside with all of these is the retirement withdrawals will be taxed as income. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

The calculator requires a total of seven inputs to. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. A withdrawal savings calculator that optionally solves for withdrawal amount starting amount interest rate or term.

This is a very. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life.

Annual interest rate - The average interest rate or APY on your savings. This calculation estimates the monthly amount a person can withdraw from their savings in order to make it last a given period of time. Basically hardship withdrawals mean youre able to take money from your 401k before you reach age 59 ½ but most of the time you will still be hit with the penalty.

Column Two Rival Experts Agree 401 K Plans Haven T Helped You Save Enough For Retirement How To Plan Changing Jobs Retirement Accounts

15 Best Investment Apps For Beginners In 2022 Updated Ranks

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

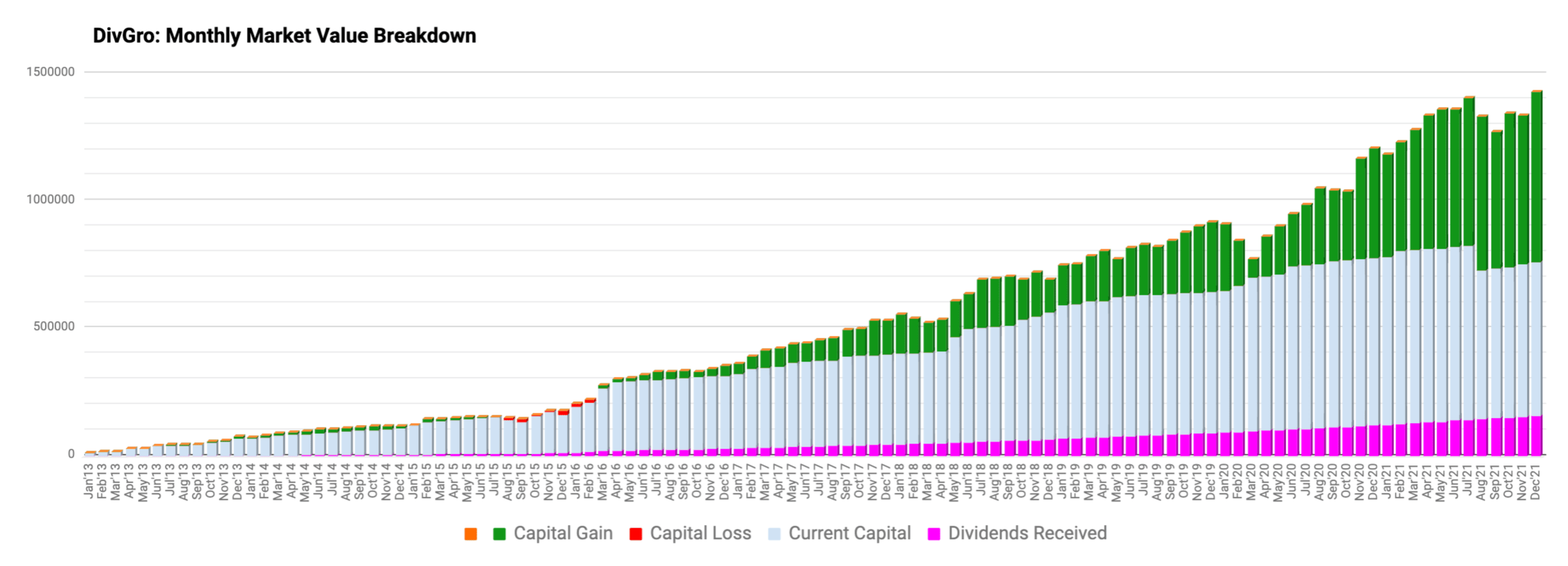

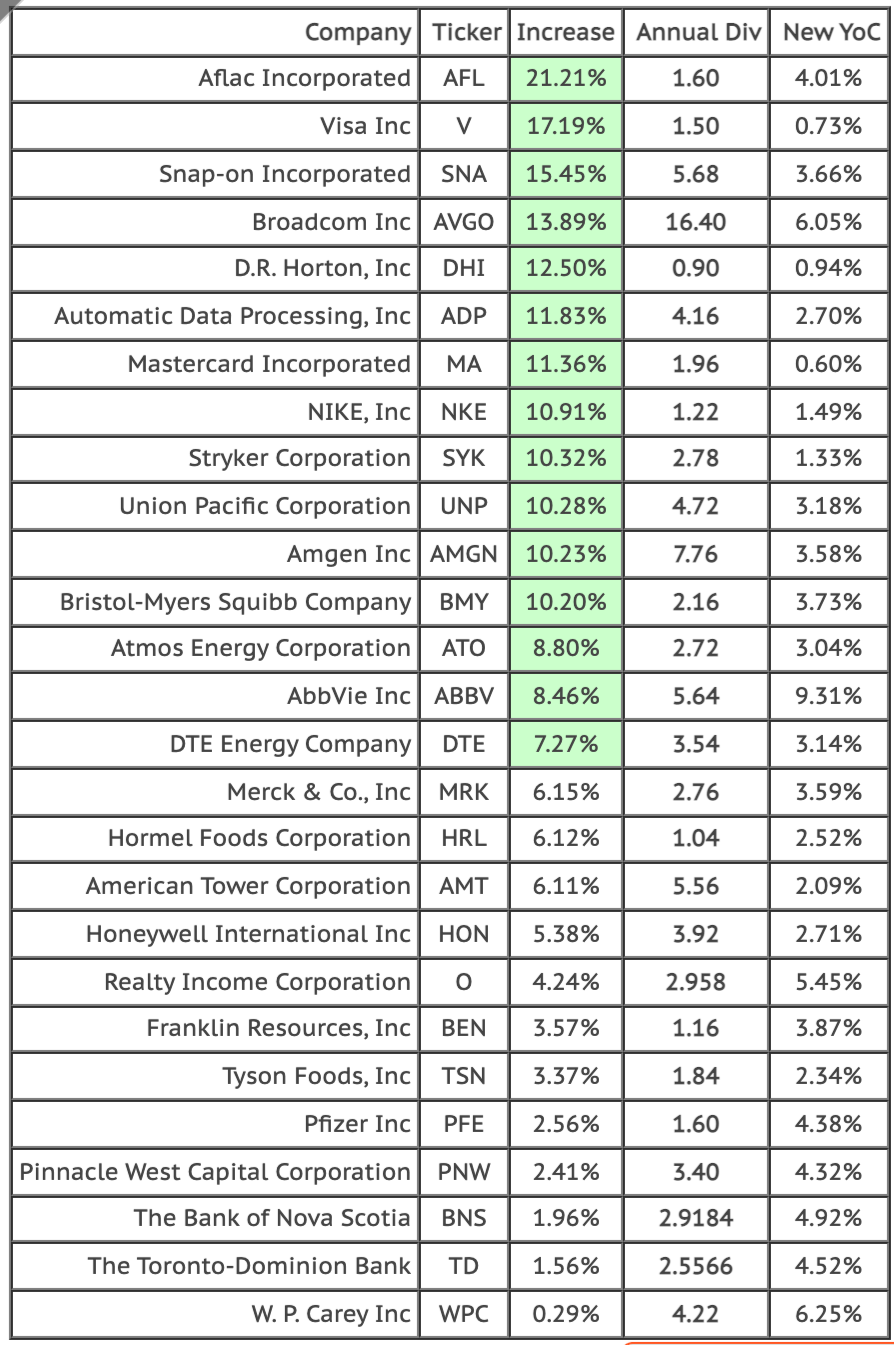

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

I Am 29 I Have No Savings Or Financial Back Up Plan What Can I Do To Be Financially Smarter Save And Have A Better Financial Future As A Single Female Teacher

I Am 29 I Have No Savings Or Financial Back Up Plan What Can I Do To Be Financially Smarter Save And Have A Better Financial Future As A Single Female Teacher

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Free 9 Employee Payroll Report Samples Active Balance History

15 Best Investment Apps For Beginners In 2022 Updated Ranks

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

2

15 Best Investment Apps For Beginners In 2022 Updated Ranks

I Am 29 I Have No Savings Or Financial Back Up Plan What Can I Do To Be Financially Smarter Save And Have A Better Financial Future As A Single Female Teacher

I Am 29 I Have No Savings Or Financial Back Up Plan What Can I Do To Be Financially Smarter Save And Have A Better Financial Future As A Single Female Teacher

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

I Am 29 I Have No Savings Or Financial Back Up Plan What Can I Do To Be Financially Smarter Save And Have A Better Financial Future As A Single Female Teacher